advantages and disadvantages of llc for rental property

AdvantagesDisadvantages of Setting up LLC for Rental Properties. THE ADVANTAGES AND DISADVANTAGES TO.

Llc For Rental Property Pros Cons Explained Simplifyllc

The drawbacks of having rental properties include a lack of liquidity the cost of upkeep and the potential for difficult tenants and for the neighborhoods appeal to decline.

. Here are some of the benefits of investing in rental. AdvantagesDisadvantages of Setting up LLC for Rental Properties. Forming an LLC will help to protect your personal assets.

The possible downside here is that. For property owned more than a year youll pay the lower long-term capital gain rate. For many years lawyers financial advisors and tax accountants.

This can have a dramatic impact on the profitability of a. Three Cons of Using an LLC for Single Family Rental Properties. Depending on your specific situation and unique circumstances the following may be considered pros for.

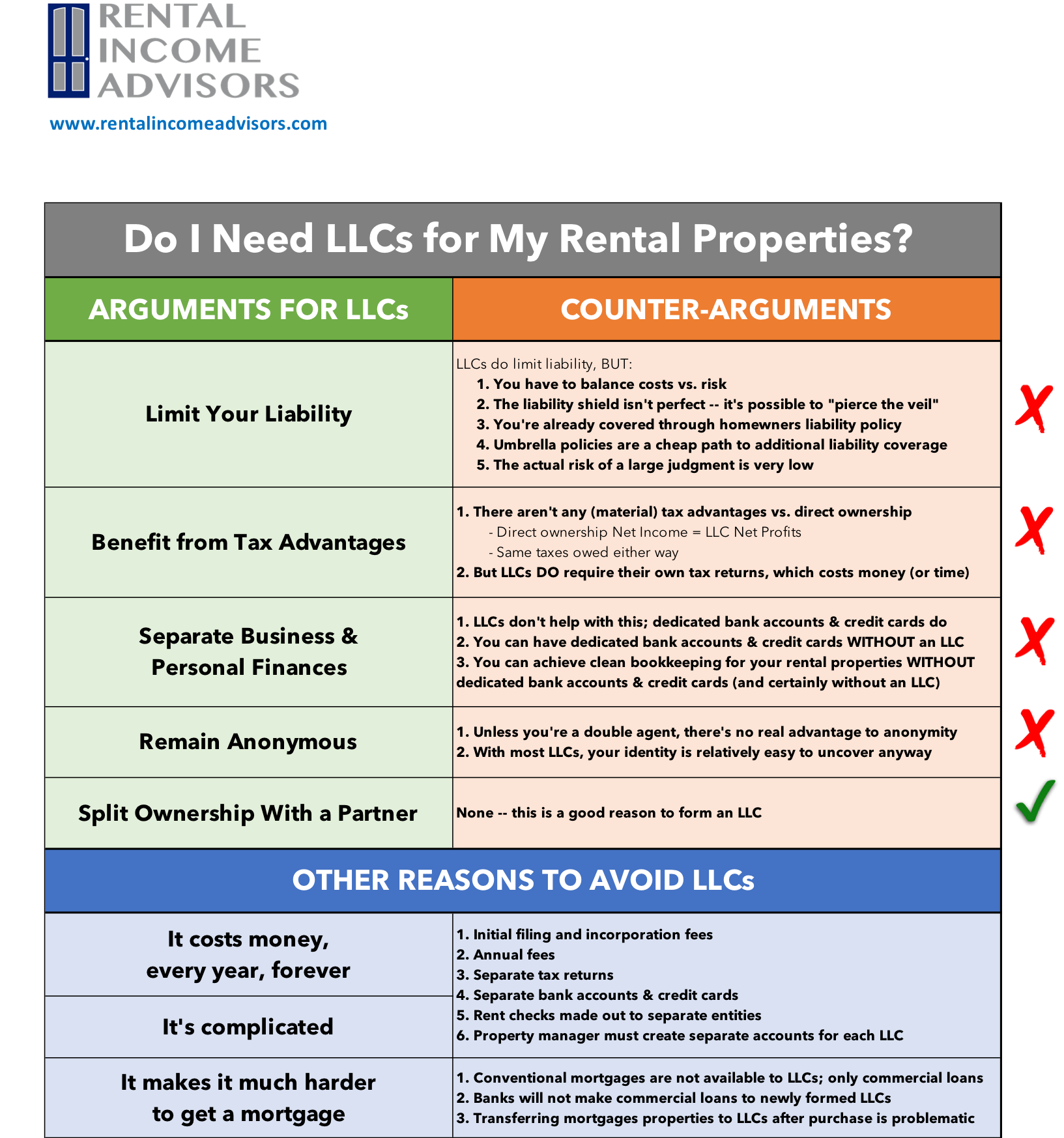

Most discussions of the tax advantages of an LLC for your rental properties are quite misleading because they tell you why an LLC is advantageous vs. Ad See How Easily You Can File an LLC in Your Desired State With These LLC Formation Services. Compare the Top 10 Companies for Filing an LLC Online and Choose The Best for You.

Ad Well do the legwork so you can set aside more time money for your rental property biz. Some of these benefits include. For tax purposes an LLC allows you to treat a large number of rental property expenses as tas deductible entities.

Alternatives to an LLC for Rental Properties. Advantages of Rental Properties. Potential to deduct mortgage interest and rental income.

Greater flexibility ie. Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets. Pass-through tax advantages.

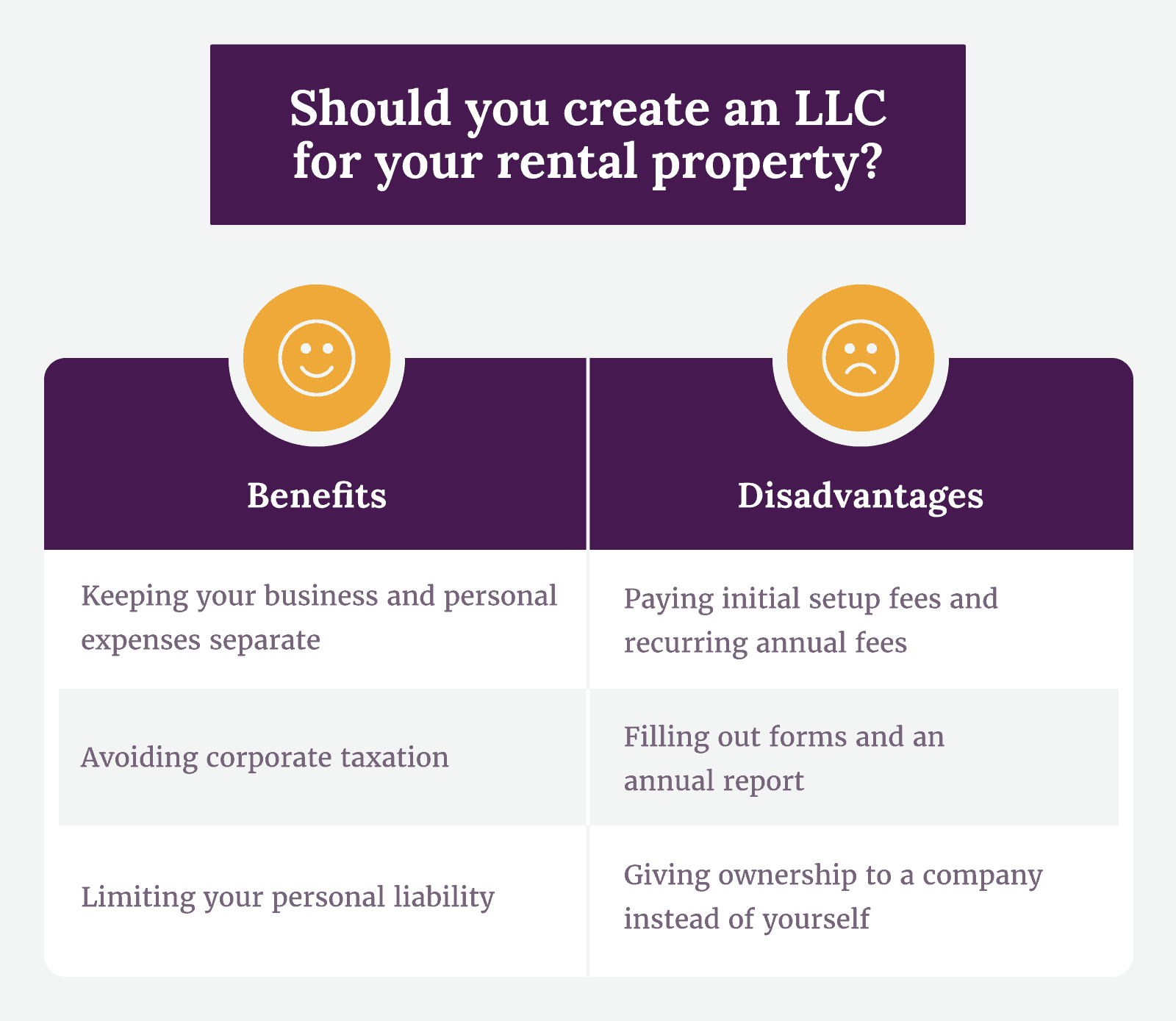

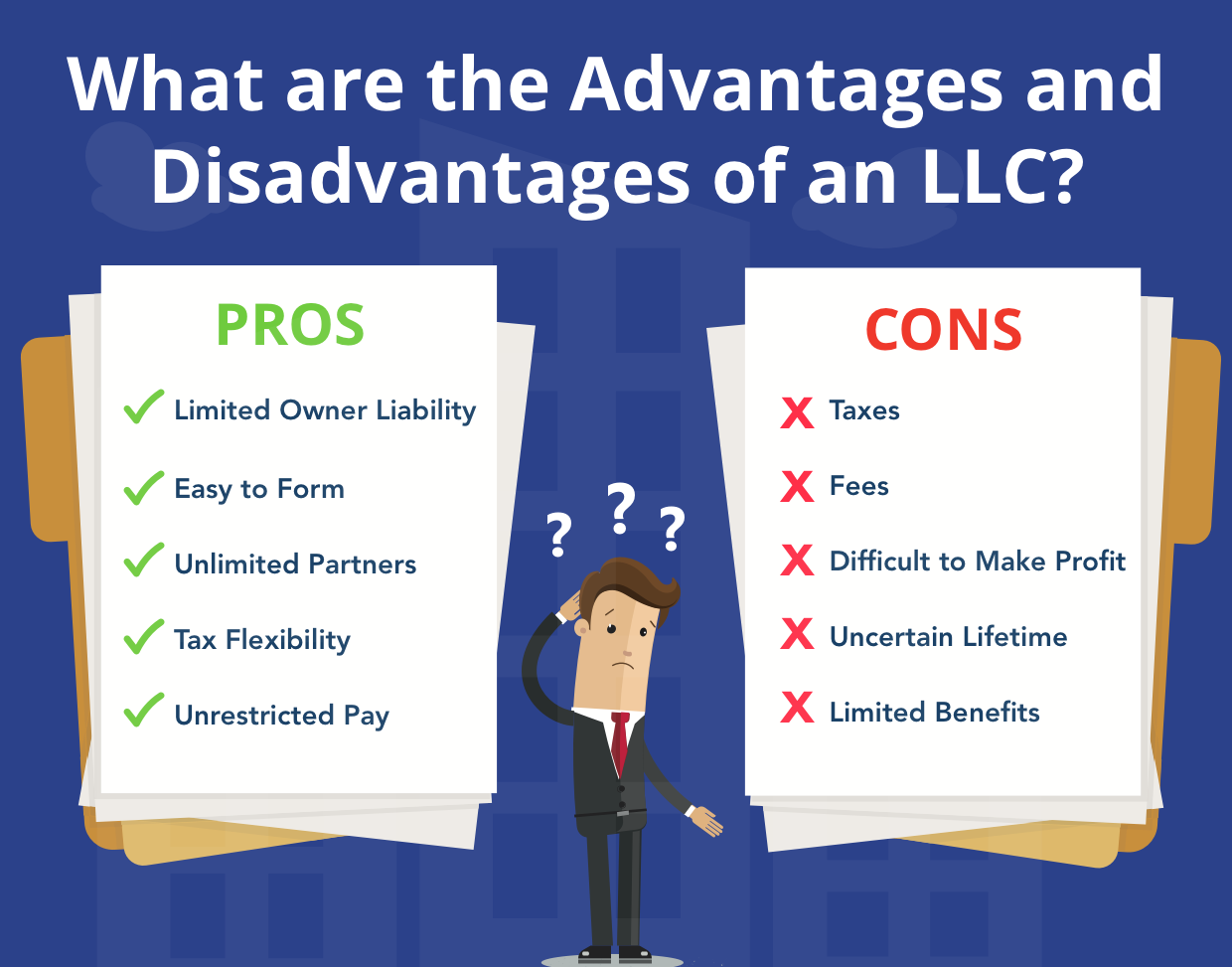

Using a limited liability company to protect your rental properties has many advantages but a few disadvantages too. Ad Our Business Specialists Help You Incorporate Your Business. Some of the benefits of an LLC include personal liability protection tax flexibility their easy startup process less compliance paperworkmanagement flexibility distribution.

There is a fee to create an LLC and most states charge an annual registration fee. Forming an LLC means you can avoid double. If you sell rental property youll pay tax on any capital gain realized.

LLCs do cost money. We offer services to help keep your Real Estate LLC compliant like tax IDEIN licenses. We offer services to help keep your Real Estate LLC compliant like tax IDEIN licenses.

While owning rental property is an excellent way to invest capital many investors also buy it as a unique tax shelter. There are many advantages to establishing an LLC for your rental properties. Aside from an LLC a sole proprietorship is one of the most popular options for property owners.

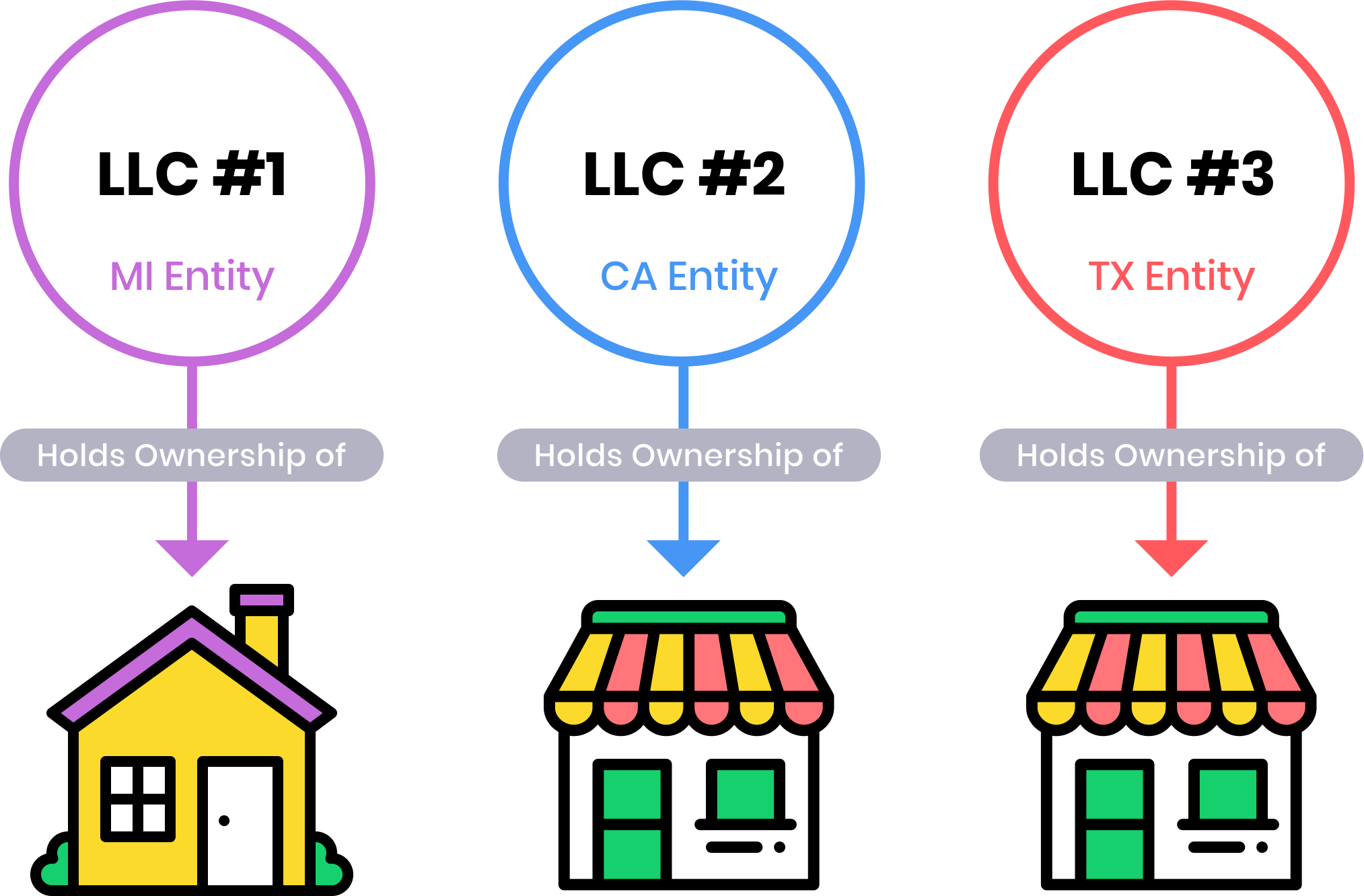

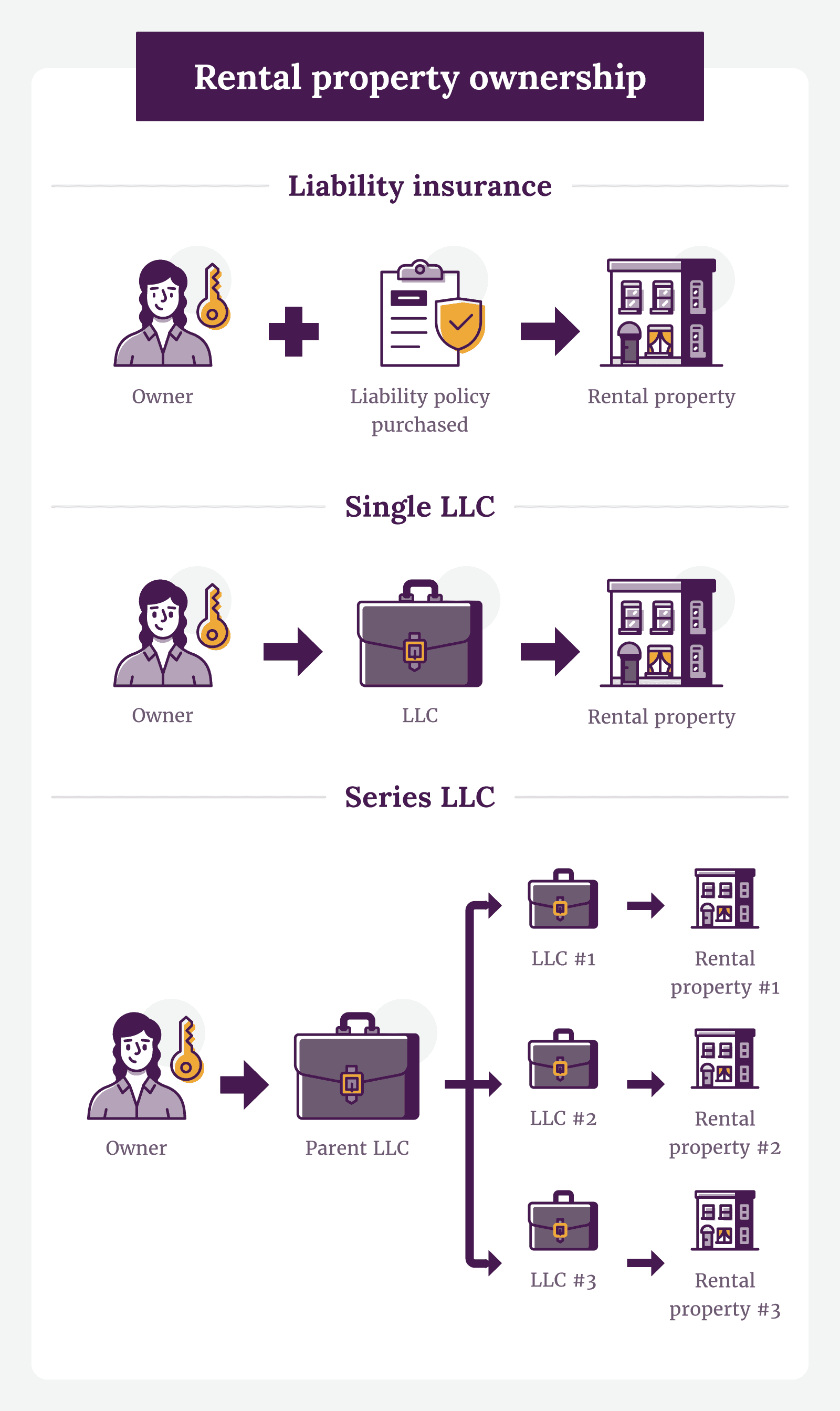

While there are some benefits to buying a rental property through an LLC there are also some drawbacks. An LLC for rental property can be a single-member LLC or have multiple members. Distribution of profits and.

One of the disadvantages of using an LLC for a real estate rental. If rental properties are part of your investment portfolio then. Tax Disadvantages Advantages of Rental Property.

While there arent always specific tax advantages for landlords its worth noting that there arent any disadvantages either. What are the Advantages and Disadvantages of Buying Rental Properties. Buying a rental property as an LLC often requires more in fees a.

Even with the above advantages to using an LLC for single family rental properties no solution is completely. The main reason investors prefer to have their rental properties in an LLC is for asset protection. Ad Well do the legwork so you can set aside more time money for your rental property biz.

Three advantages to using an LLC for rental property are pass-through of income and losses. List of the Pros of Using an LLC for a Rental Property. Disadvantages of a Real Estate Limited Liability Company Fees Fees and More Fees While a real estate LLC allows you to save money from tax deductions there are costs.

Should I Create An Llc For My Rental Property Ny Rent Own Sell

Should You Form An Llc For Rental Property 2022 Bungalow

Advantages And Disadvantages Of Owning Rentals In An Llc

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

The Tax Benefits Of An Llc For Rental Property New Silver

Llc For Rental Property Pros Cons Explained Simplifyllc

Should I Transfer The Title On My Rental Property To An Llc

Benefits Of Buying A Rental Property Through An Llc Avail

Should You Create An Llc For Rental Property Pros And Cons New Silver

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

20 Pros And Cons Of Creating An Llc For Your Rental Property

Llc In Nyc Real Estate Pros And Cons Nestapple New York

![]()

Can I Put My Primary Residence In An Llc New Silver

Should You Put Rental Properties In An Llc White Coat Investor

Should You Put Your Rental Property In An Llc Truic

Llc For Rental Property Pros Cons Explained Simplifyllc

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

Llc For Rental Property What Should Real Estate Investors Do