corporate tax increase canada

The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement. 10 effective January 1 2018.

Capital Gains Tax Capital Gain Integrity

Such a tax has the effect of reducing domestic investment.

. Elected on May 5 2015 announced an increase in the general corporate tax rate from 10 to 12 effective July 1 2015. Here is a summary of changes to key federal non-refundable tax credits for 2022. The government of Canada increases the tax on corporate profits.

In the long-term the Canada Corporate Tax Rate is projected to trend around 2650 percent in 2021 according to our econometric models. Note that this increase is based on an enhanced formula that is designed to bring this amount up to 15000 in 2023. Rate of 390 per centsee chart below.

At a provincial and territorial level the small business deduction ranges between 0 and 8. Canadas real exchange rate will increase and then fall. With this measure Albertas.

Based on the statistical results a one percentage point drop in the combined corporate tax rate would increase the average wage of Canadian workers by between 254 and 390 the following year. Those who want to open companies in Canada should know that corporate tax rates can change during the year. Corporate Tax Rate in Canada is expected to reach 2650 percent by the end of 2020 according to Trading Economics global macro models and analysts expectations.

We estimate an increase in the corporate tax rate to 28 percent for example would reduce long-run economic output by 08 percent eliminate 159000 jobs and reduce wages by 07 percent. 2 days agoWhat Is The Corporate Tax Rate In Canada For 2020. And higher sales taxes also dont tend to drive business out of Canada to the same degree that corporate tax hikes do he adds.

26 on the portion of taxable income over 98040 up to 151978 and. The corporate tax rate on large financial institutions mostly banks and life insurers would climb three percentage points to 18 from 15 and apply to earnings above 1 billion Canadian dollars. What effect would this tax increase have on Canadas real exchange rate.

After the general tax reduction the net tax rate is 15. This measure is included in Bill 20 which received first reading on May 24 2016. For Canadian-controlled private corporations claiming the small business deduction the net tax rate is.

Based on global macro models and analyst expectations Trading Economics projects a 50 percent growth rate by the end of 2020. 2 days agoWhat Is The Canadian Corporate Tax Rate For 2020. In Canada both the federal government and the provincialterritorial governments levy corporate income taxes.

Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to 396 from 37 among other amendments. 9 effective January 1 2019. The evidence is clear.

According to projections the Corporate Tax Rate in Canada will reach 26 percent. As a result Albertas combined federal-provincial general corporate tax dropped from 25 percent to 23 percent the lowest general corporate tax rate in Canada and lower than that of 44 US. Raising corporate taxes is bad economic policy.

The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. The following tax rates need to be considered when it comes to the Canadian corporate tax. 14398 up from 13808.

29 on the portion of taxable income over 151978 up to 216511 and. 15 on the first 49020 of taxable income and. Trudeau said that if re-elected his government would raise the corporate income tax rate by three percentage points from 15 per cent.

For small CCPCs the net federal tax rate is levied on active business income above CAD 500000. Fortunately governments in Canada have recognized the damaging effects of corporate taxes. Download the tax tables summarizing the federal and provincialterritorial tax rates applied to income earned by Canadian-controlled private corporations CCPCs and general corporations.

Yet according to OECD data Canadas combined federal-provincial corporate income tax rate 263 per cent is currently 15th highest among 34 OECD countries our statutory rate however is much lower than the US. Corporation income tax overview Corporation tax rates Provincial and territorial corporation tax Business tax credits Record keeping Dividends Corporate tax payments Reassessments. Through the Business Profits War Tax Act Canadas federal government introduced a corporate income tax in 1916 to help fund the countrys involvement in the First World War.

From a GDP perspective Canada will likely have a GDP of 27. A corporate surtax was implemented in 1968 and in 1985 capital began to be taxed as part of an effort to increase corporations contribution to total federal tax revenue. This translated to the reduction of Albertas general corporate income tax rate from 10 percent directly to 8 percent effective from July 1 2020.

A federal rate of 9 applies to the first CAD 500000 of active business income. For instance Emmas 2021 and 2022 taxable income remains. Add the federal and provincialterritorial tax.

205 on the portion of taxable income over 49020 up to 98040 and. Canadas Corporate Tax Rate is estimated to reach 27 by the year 2025. Global macro models from Trading Economics predict that by 2020 the world economy will grow at least 50 percent.

The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. Canadas real exchange rate will fall and then increase. A 100000 individuals top tax rate is now 305 down from 36.

A 25 percent tax rate would reduce output by 04 percent and result in about 84000 fewer full-time equivalent jobs. The April 14 2016 budget proposed a reduction in the small business tax rate from 3 to 2 effective January 1 2017. Investment income other than most dividends of CCPCs is subject to the federal rate of 28 in addition to a refundable federal tax of 10⅔ for a total federal rate of 38⅔.

Canadian corporate taxation is set to trend around 26 in the medium to long term. File corporation income tax find tax rates and get information about provincial and territorial corporate tax.

Progressiveness Of Taxes Informative Tax Facts

Uncompetitive Us Corp Tax Structure Corporate Tax Rate Japan Germany

Canadian Government Revenues From Tobacco Taxes An Update Physicians For A Smoke Free Canada

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At A Developing Country Gross Domestic Product Social Data

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Benefits Of Incorporating Business Law Small Business Deductions Business

Chart Per Capita Ghg Emissions Tonnes Of Co2 Equivalent For Selected Countries 1990 2013 Global Warming Ghg Emissions Climate Policy

Pin On Social Class Income Inequality

Taxtips Ca Canada S Top Marginal Tax Rates By Province Territory

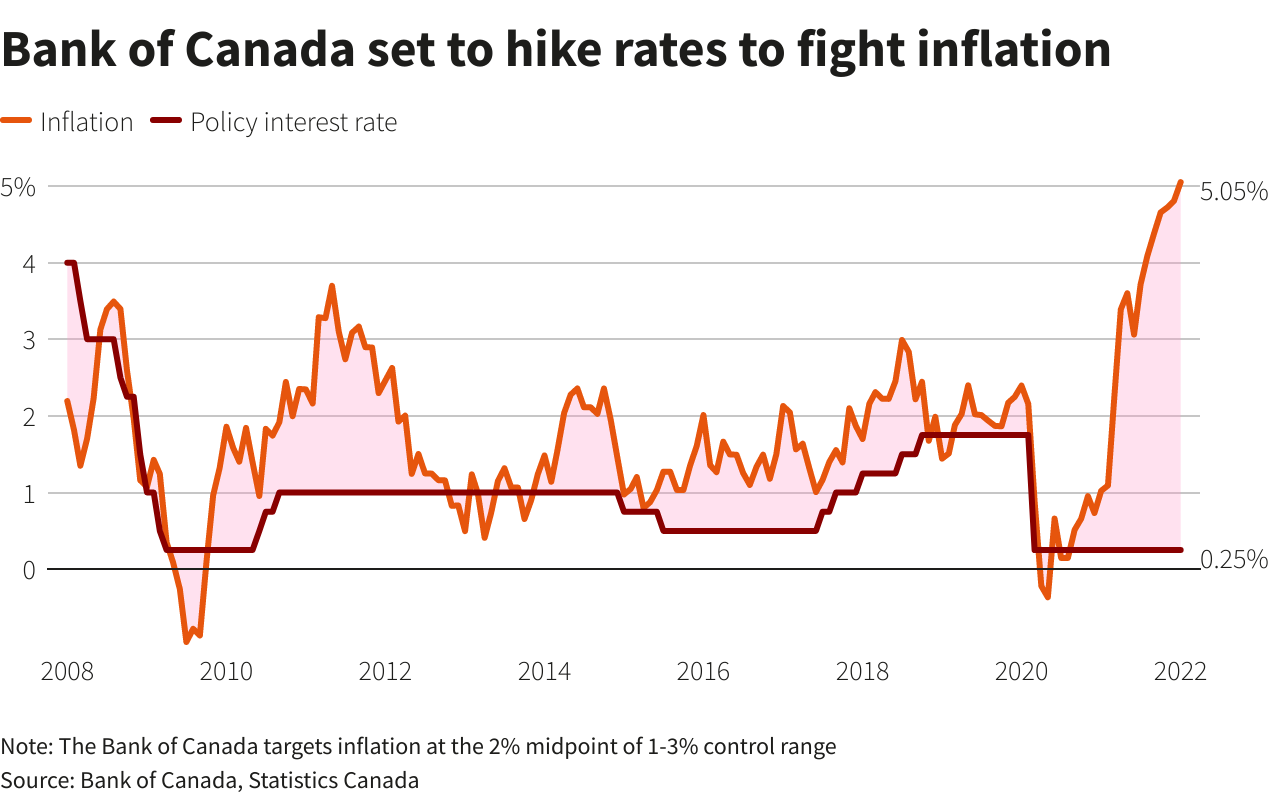

Bank Of Canada Seen Set To Hike For First Time Since 2018 Reuters

Corporate Income Tax Definition Taxedu Tax Foundation

Marvel S Meteoric Rise Chartr Data Storytelling How To Be Single Movie Marvel Storytelling

2021 It Job Market And Bls Data Analysis By Janco Marketing Jobs Communications Jobs Job Satisfaction

Net Household Savings Rate In Selected Countries 2019 Basic Concepts Savings Corporate Bonds